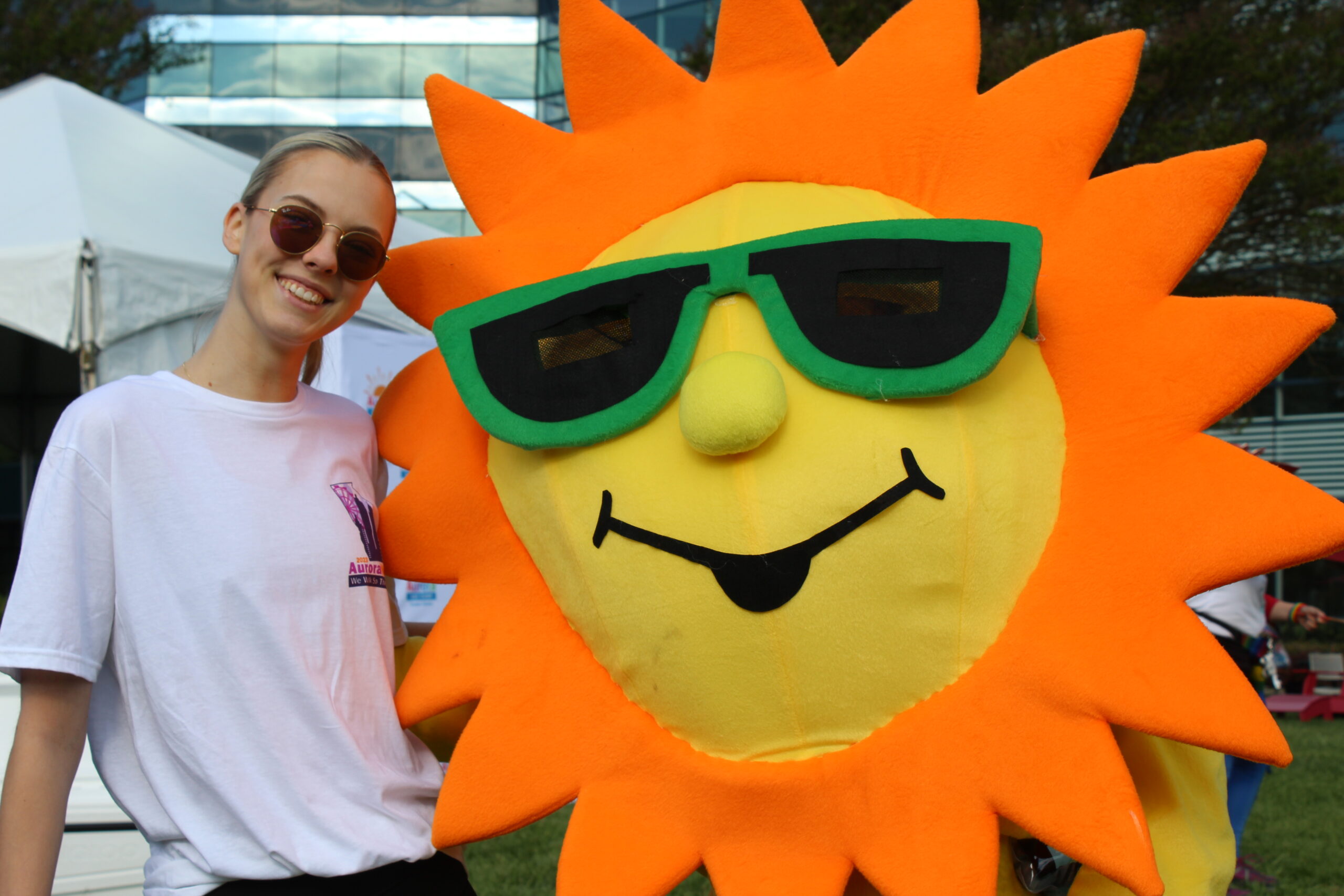

Giving Hope, Strength and Joy to Children with Cancer and Their Siblings

Sharing Happiness

In 2023 alone, Sunrise Association has brought joy to over 45,000 children battling cancer and their siblings.

01234567890123456789012 , 012345678901234567890 012345678901234567890123456789 012345678901234567890

Campers at Sunrise Day Camps in 2023

0123456789012345678901234 , 01234567890123456789012345678 0123456789012345678901234567 01234567890123456789012345

Children participating in our in-hospital programs

012345678901234567890123 01234567890123456789012345678 , 012345678901234567890123456 012345678901234567890123456 012345678901234567890123456789

Kids engaged through Sunrise virtual programs

0123456789012345678901 Millon

Sunrise Smiles

Spreading Smiles Around the World

Sunrise’s magic stretches from coast to coast in the US and around the world. We’re bringing smiles to children everywhere by opening new camps and expanding our in-hospital programs.

0123456789012345678901 01234567890123456789012

Day Camps

012345678901234567890123456 01234567890123456789012

Sunrise On Wheels Programs

0123456789012345678901 012345678901234567890123456 0123456789012345678901234567

Hospitals reached by Virtual Programming

News & Events

Impact in Every Donation

Every dollar you give helps us spread joy in countless ways. While donations are used where they are most needed, your generosity could help provide toys, a day filled with laughter at camp, or sweet summer treats for our brave children.

$300

$300

Fill the Sunrise on Wheels Trunk with Toys

$150

$150

One day at Sunrise Day Camp

$50

$50

Ice cream for the summer for a child